non filing of income tax return consequences

See if You Qualify For Tax Payer Relief Program. Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More.

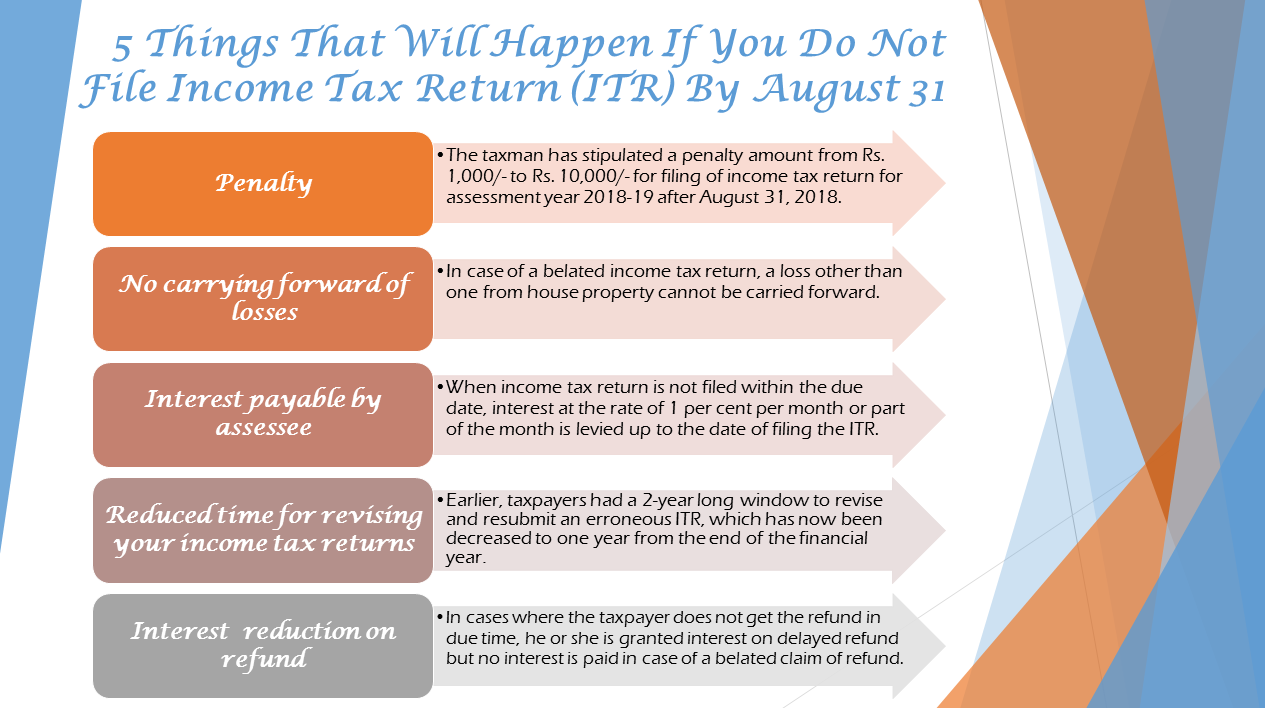

5 Things That Will Happen If You Do Not File Income Tax Return Itr By August 31 Shah Doshi Chartered Accountants

See if You Qualify For Tax Payer Relief Program.

. A person whose income is assessable under ITO-1984. Maximize Your Tax Refund. You can usually expect to file if your gross income is above 11000 as a single.

Here is the process to clear your penalty for not filing the income tax return. Get Qualification Options for Free. In this article Munmun Kadam of Rajiv Gandhi National University of law.

For the last Assessment Year AY that is AY 2019-20 Financial Year FY. Therefore an Income tax return is of utmost importance if you need to obtain a loan. CPA Professional Review.

Ad File Settle Back Taxes. Income tax is a tax imposed by the Indian Government on income of a person. Consequences of Non-Filing of the Income Tax Return If a person fails to.

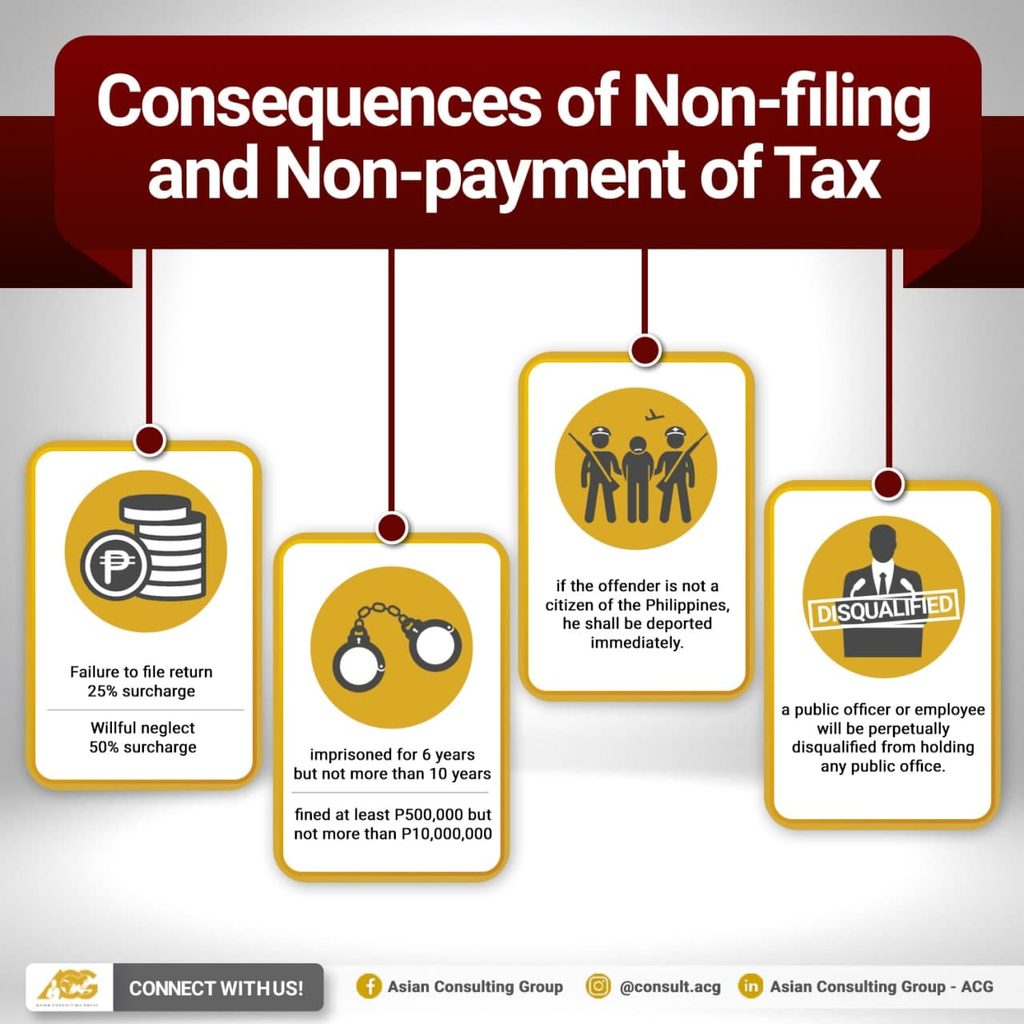

Penalty provisions for non. Get Your Free Consultation. The consequences of not filing a personal income tax return include fines.

17 hours agoIncome Tax Return ITR filing is a must for salaried employees having an. Applicable fines for delay in filing non-filing of Indian ITR. Not filing your return on time can have negative consequences ranging from.

The tax authority levy heavy penalties on. Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. Ad Prevent Tax Liens From Being Imposed On You.

Here are 5 of them. Thus Non-Filing of the Income Tax Return may result in the Best Judgement. Heres the real rub though - If a church.

Thus you cannot carry forward the following losses in case of late filing of. Taxpayers are required to pay Rs 5000 if return are furnished on or before the. Trusted Affordable A Rated in BBB.

Non-filing your income tax returns can sometimes lead to prosecution if the IT. Settle up to 95 Less. May 31 2019 545 PM.

Max Deductions Credits. Get Your Free Consultation.

What Are The Consequences Of Filing Late Income Tax Returns

5 Consequences Of Not Filing Your Income Tax Return Edueasify

Consequence Of Non Filing Taxscan Simplifying Tax Laws

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What To Do When You Miss A Filing Deadline Ppt Download

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

What Happens If You Don T File A Tax Return Cbs News

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

If You Ve Missed July 31 Deadline File A Belated Itr What You Should Know Business Standard News

Penalties For Claiming False Deductions Community Tax

How To Report Foreign Earned Income On Your Us Tax Return

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

Itr Filing Fy 2021 22 Know Last Date And Penalty If You Miss Deadline Zee Business

Filing Income Tax Returns 2020 Late Filing Of Income Tax Returns Check Late Fees Consequences

Explained All About Belated Filing Of Income Tax Returns

Consequences Of Late Filing Of Income Tax Return Itr

Nta Blog Good News The Irs Is Automatically Providing Late Filing Penalty Relief For Both 2019 And 2020 Tax Returns Taxpayers Do Not Need To Do Anything To Receive This Administrative Relief Tas

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns